Stable US Jobs Data: Bitcoin Market Impact Analysis – November 8 Report

Drew

Drew

U.S. Jobless Claims Dip Slightly Amid Restart of Official Data

Initial jobless claims in the U.S. edged lower to 227,543 for the week ending November 8, down from 228,899 the prior week—a modest but meaningful decline. This figure aligns closely with expectations from major Wall Street firms like JPMorgan and Goldman Sachs.

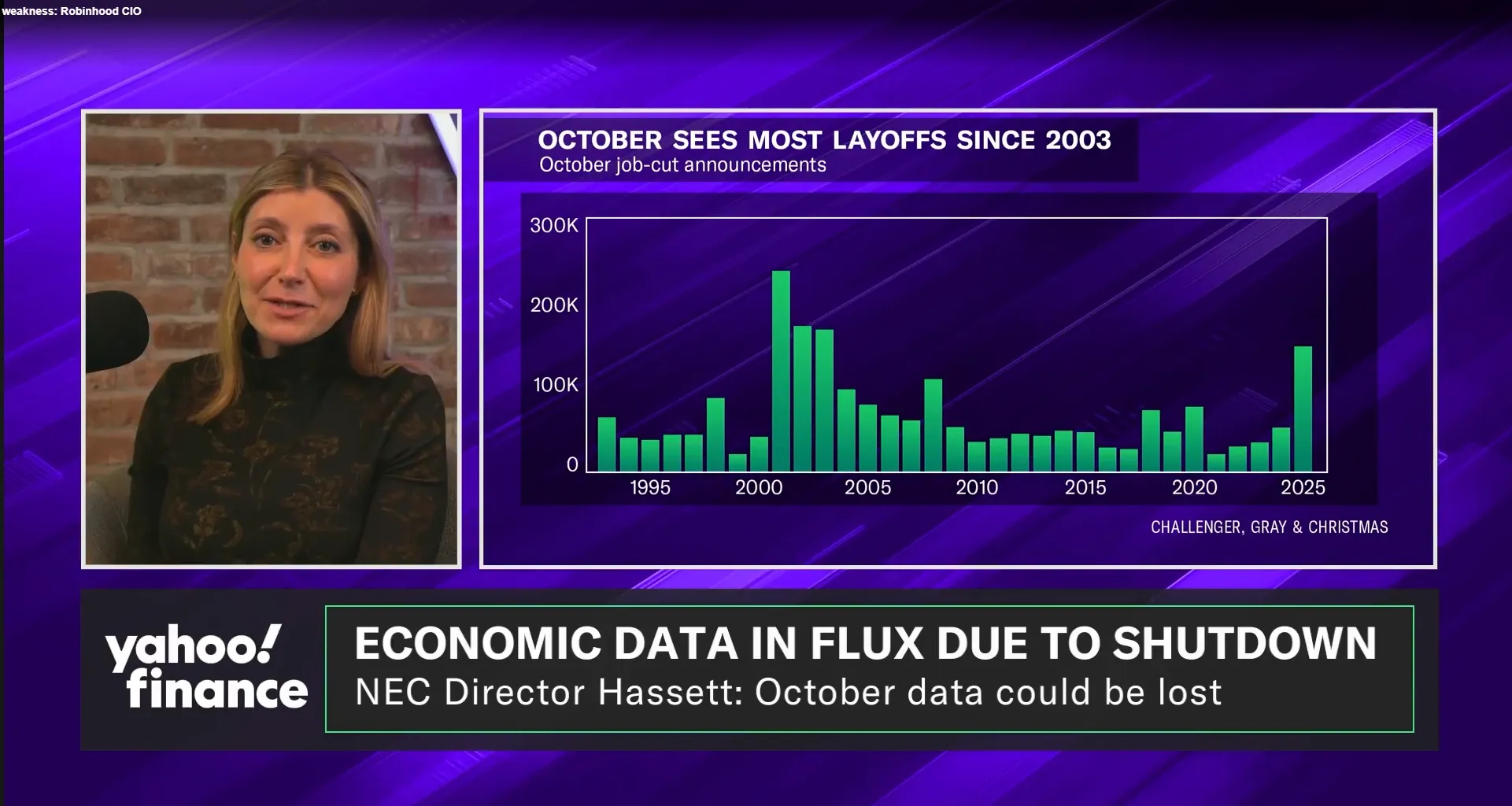

It's worth noting that for over six weeks, official economic data had been on hold due to the 43-day government shutdown. As a result, this number was derived by third-party analysts using raw state-level unemployment filings. Despite layoffs reported at companies such as Amazon during the shutdown, the broader trend suggests a labor market holding steady—neither expanding nor contracting sharply. That balance points to resilience rather than distress. With the shutdown now resolved, the Labor Department is expected to resume regular publication of claims data next week, bringing transparency back to the macro narrative.

Source: US weekly jobless claims edge down, Haver Analytics estimates

What This Means for the Fed

The stability in employment strengthens the argument that the Federal Reserve should keep interest rates unchanged at its December meeting. After two rate cuts earlier this year, policymakers have increasingly signaled caution. Concerns about inflation persistence—especially in services and wage growth—remain present, even as the labor market shows no signs of weakening.

A solid jobs picture reduces immediate pressure to cut further. Holding rates steady helps avoid triggering tighter financial conditions, which could dampen risk appetite across asset classes. That's good news for risk assets like Bitcoin, whose price tends to respond positively when liquidity remains stable and markets aren't pricing in an imminent recession.

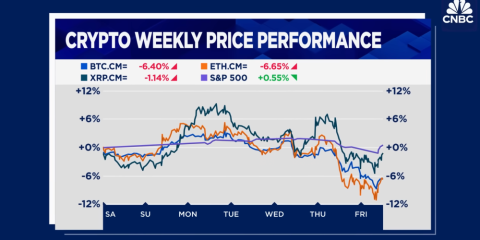

Bitcoin's Market Outlook: From Consolidation to Clarity

Short-Term (Now - December): Neutral-Positive, Consolidating

With recession fears receding slightly thanks to the resilient labor market, investor sentiment has lifted across equities and crypto. Bitcoin is currently trading between $105,000 and $115,000—recovering from a brief dip below $100K in early November. Expect choppy but range-bound action near $110K-$115K in the coming weeks, as traders wait for clearer signals from the Fed. Volatility has cooled, suggesting consolidation is likely ahead of the December decision.

Medium-Term (December Onward): Steady Upward Momentum if Rates Hold

If the Fed stands pat in December, it could trigger a shift toward sustained confidence in stable monetary policy. In that scenario, Bitcoin may push above $115K, targeting a range of $115K to $120K. Institutional demand remains strong—BlackRock's Bitcoin holdings, for example, have grown 30% year-to-date. Ongoing ETF inflows, including $7.8 billion in Q3 and $3.2 billion in October alone, continue to anchor market momentum. These flows are no longer just speculative—they reflect real capital allocation.

Long-Term: Cementing the “Digital Gold” Narrative

As the economy avoids a hard landing and the Fed maintains a cautious but steady hand, the idea of a "soft landing" gains traction. In this environment, Bitcoin's role as a hedge against inflation and currency devaluation becomes harder to ignore. With 72% of Bitcoin supply—about 14.3 million BTC—now locked in long-term holdings (i.e., not actively traded), selling pressure is minimal. These coins are held by investors who view Bitcoin not as a short-term bet, but as a store of value.

Over time, as institutional adoption deepens and retail participation stabilizes, we're likely to see less volatility and more sustainable price appreciation. That's the foundation of a true long-term bull case.

Current Bitcoin Market Metrics

| Indicator | Latest Data | Market Significance |

|---|---|---|

| Price Range | $105K - $115K | Recovering from early-November lows; showing resilience |

| Institutional Holdings | BlackRock et al. hold 2.88M BTC (+30% YTD) | Strong institutional confidence driving support |

| ETF Flows | Q3 net inflow: $7.8B; October: $3.2B | Continued institutional interest fuels market focus |

| Non-Circulating Supply | 14.3M BTC (72% of total) | Low sell pressure from long-term holders |

Investment Perspective: Strategy & Risks

Positioning Guidance

- Short-term: Look to accumulate near $108K support levels. A decisive break above $115K would be a bullish signal.

- Medium-term: Maintain exposure through the December Fed meeting. Target $115K-$120K if policy stays steady.

- Long-term: Monitor ETF inflows and institutional ownership trends—these are now the primary drivers of direction.

Key Risks to Watch

- A sudden drop in official jobs data could revive speculation for another rate cut, potentially triggering short-term Bitcoin pullbacks.

- An unexpected rate cut in December might spark “buy the rumor, sell the news” volatility—especially if markets were already pricing in a hold.

- Regulatory shifts or unforeseen events in the crypto space (e.g., custody issues, exchange failures, or new legislation) could disrupt the current trajectory.

Conclusion: A Clear Path Forward

Stable U.S. jobs data isn't just a headline—it's a catalyst. It feeds into a chain reaction: labor strength → Fed holds rates → stable liquidity → improved risk appetite → positive momentum for Bitcoin.

In the near term, expect sideways movement around $110K-$115K. But after the Fed's December decision, especially if rates remain unchanged, a steady climb toward $115K-$120K appears well within reach.

Longer-term, Bitcoin's evolution into a credible alternative to traditional stores of value is accelerating. With institutional capital flowing in, supply scarcity rising, and volatility moderating, the “digital gold” thesis is gaining real-world weight.

For investors, the next few months hinge on three catalysts:

- The November 25 jobs report (official release post-shutdown),

- The December FOMC meeting,

- Ongoing ETF flow trends.

Stay alert. Stay disciplined. There's opportunity here—but also room for caution. The market is at an inflection point, and timing matters.