Bitcoin: Bullish Pattern, Nov 20 Key Events & Derivatives Surge - Nov 20, 2025

Jonathan

Jonathan

Double Bottom Pattern & Trendline Breakout On Bitcoin's 4-hour chart, the price has formed a bullish double bottom pattern and broken above a long-term descending trendline, signaling a potential short-term trend reversal. Key support near $92,290 is now critical-holding here could push prices toward $96,000 or even $100,000 resistance. A break below support, however, would raise concerns about fading rally momentum. Overall, the technical confluence strengthens short-term bullish sentiment, but the battle between support and resistance will dictate the rally's longevity.

Three Key Events Converge on November 20

With the U.S. government reopening, global markets face a pivotal convergence of three major events on November 20: Fed policy signals, NVIDIA's Q3 earnings, and critical U.S. labor data. Market consensus holds that outcomes will shape Q4 asset allocation strategies.

Fed Policy Signals: Internal Divisions Take Center Stage

Fed dynamics kick off early: Richmond Fed President Barkin (2027 FOMC voter) speaks at 01:45 GMT, likely reinforcing his "cautious easing" stance on U.S. economic soft landing. Then at 03:00 GMT, the Fed releases October meeting minutes alongside a speech from New York Fed's Williams (permanent FOMC voter). Market data suggests deep policy divisions in October, with 70% pricing in a December hold-this release will validate that expectation.

NVIDIA Earnings: The Tech Sector's Barometer

NVIDIA's Q3 results (post-market, 05:00 GMT) will dominate tech sentiment. Consensus expects 5.49Brevenue(+5646.74B. As the undisputed GPU market leader (84%+ share), NVIDIA's performance acts as a tech sector valuation anchor. Beat expectations? Expect a Nasdaq/AI sector lift. Miss? Potential profit-taking could pressure broader markets amid existing valuation concerns.

U.S. Labor Data: The Late-Night Catalyst

At 21:30 GMT, U.S. September unemployment (4.30%, flat vs. prior), non-farm payrolls (50K, vs. 22K), and initial jobless claims (230K) will gauge labor market health. Strong payroll growth suggests economic vigor; elevated claims typically signal dollar weakness and gold strength.

Market Outlook: The Q4 Turning Point

The convergence of Fed signals, NVIDIA results, and labor data creates high volatility. Key dynamics:

If jobs data beats expectations and claims stay low, "strong economy + loose policy" narrative gains traction.

Weak jobs data could cement a December hold, pressuring risk assets.

NVIDIA's results will dictate tech capital flows-strong beats fuel rallies, misses trigger sector-wide profit-taking.

The outcome of these three events will likely define Q4 market direction.

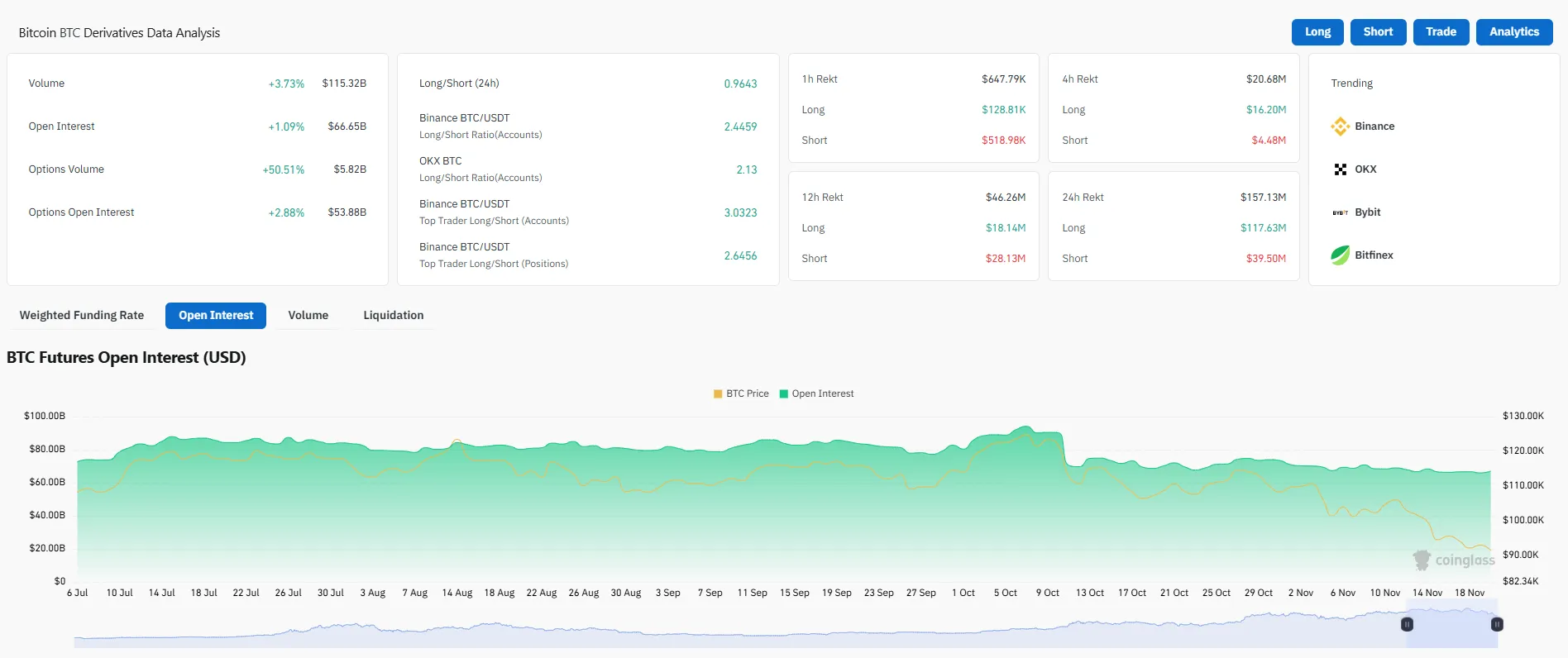

Options Volume Surges on Bitcoin Derivatives

Bitcoin derivatives markets show broad expansion. Futures volume rose 3.68% to 11.54B,with open interest up 1.226.67B-indicating sustained institutional participation and heightened directional bets. Options, however, stole the spotlight: volume spiked 50.48% to 581.8M,open interest grew 2.875.39B. This explosive activity reflects intensified volatility hedging, speculative plays, and advanced strategies-proving traders are pricing in heightened price swings. The market isn't just active; it's evolving.