Bitcoin Trapped in $95k Tug-of-War: Fed Policy, Liquidity Gaps, and Trade Tensions

Bull

Bull

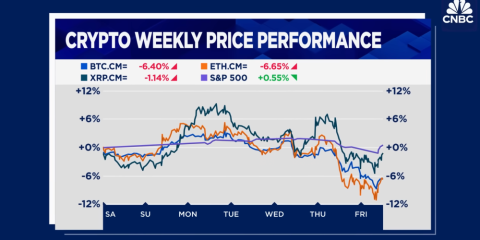

Since October 10th, the crypto market has hemorrhaged over $1 trillion in total market cap. In the past 24 hours alone, nearly 18,000 traders have been liquidated globally, with $6.8 billion in losses-70% of which came from long positions. This sharp pullback stems from three core forces: the Federal Reserve's policy shifts, global liquidity fragmentation, and the ongoing US-China trade tensions, all intersecting to shape Bitcoin's volatile trajectory.

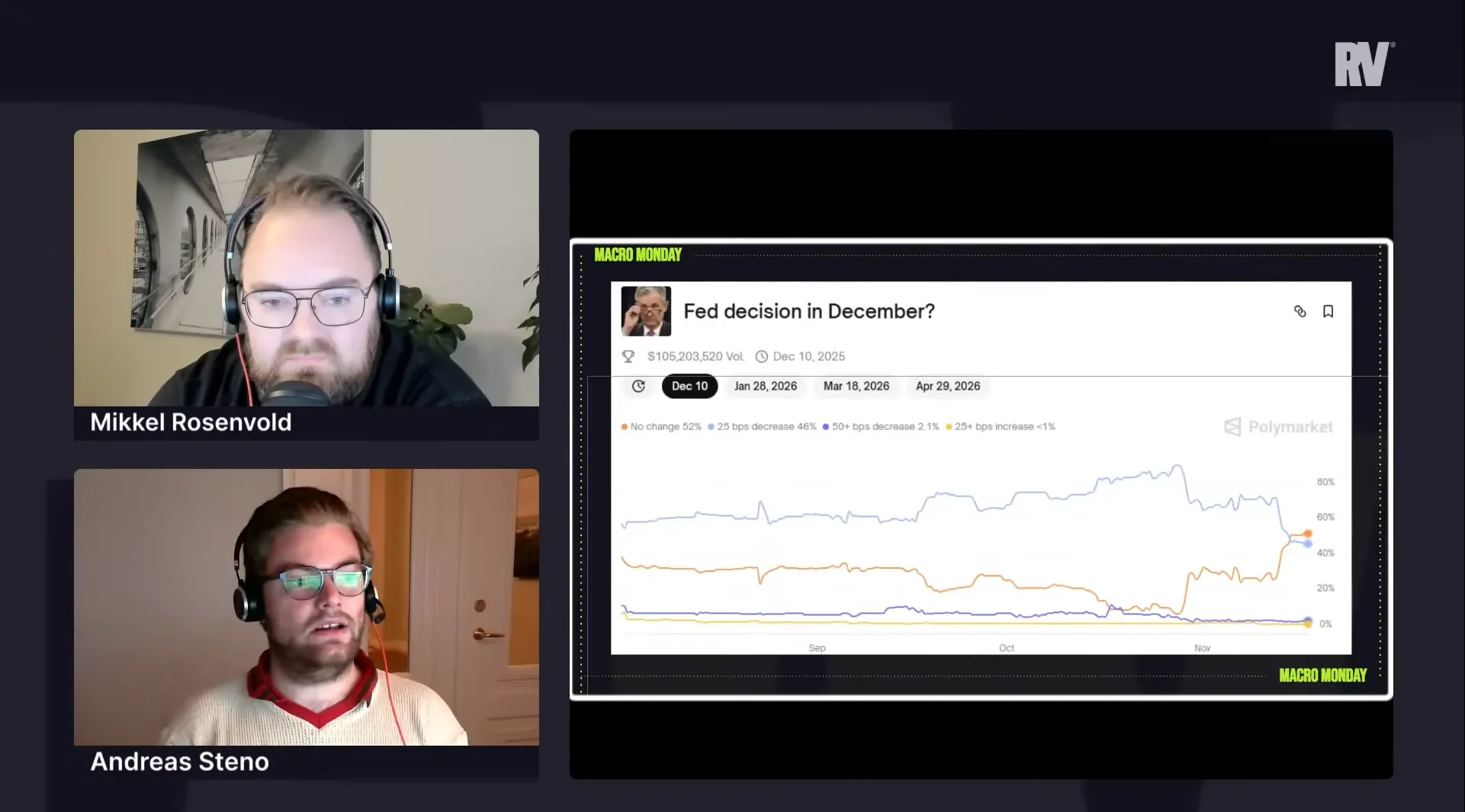

Fed Policy Uncertainty: The 50/50 Bet

Bitcoin's price remains tightly linked to Fed policy. Current market odds for a December rate cut have fallen to a 50/50 split, with some traders even betting 40/60 on a cut. The CME Fed Watch tool shows just a 51.6% probability of a 25-basis-point rate reduction, versus 48.4% for holding rates steady.

Some members like Collins and Schmidt warn that cutting rates could stall inflation's return to 2%, while others like Waller and Michelle Bowman push for continued easing. With Chair Powell remaining silent and potential candidates for the next chair still in play, the path forward is murky. The real test comes with the November CPI report: if cost pressures ease in sectors like healthcare, it could swing undecided members toward a cut.

But investors are also watching the long game. If the Fed cuts rates in December but signals the cycle is ending, that could trigger a selloff. Conversely, New York Fed's Williams hinting at an "unvoted balance sheet expansion" suggests the Fed might technically ramp up liquidity before the meeting-a potential lifeline for risk assets like Bitcoin.

Liquidity Fracture: Hope vs. Reality

The Fed's return to normal government operations should boost liquidity-but the market is seeing the opposite. With bill payments and payrolls resuming, we'd expect frozen reserves to flow into private banks. Yet, repo rates remain above 4%, and recent emergency meetings between the New York Fed and banks confirm severe dollar shortages.

Some market participants can't even access the Fed's standard repo facility, while banks avoid using it due to reputational concerns. This bottleneck means liquidity isn't reaching the market as intended. Expect the Fed to either expand its tools or restart asset purchases to ease pressure-both moves would boost risk assets.

Not everyone agrees on whether liquidity is truly tightening. Some argue Japan and Europe's steepening yield curves have already made private banks the new liquidity engines. With banks profiting from cheap borrowing and high-rate lending, global liquidity may be stronger than bond collateral values suggest-offering a silver lining for Bitcoin's medium-term outlook.

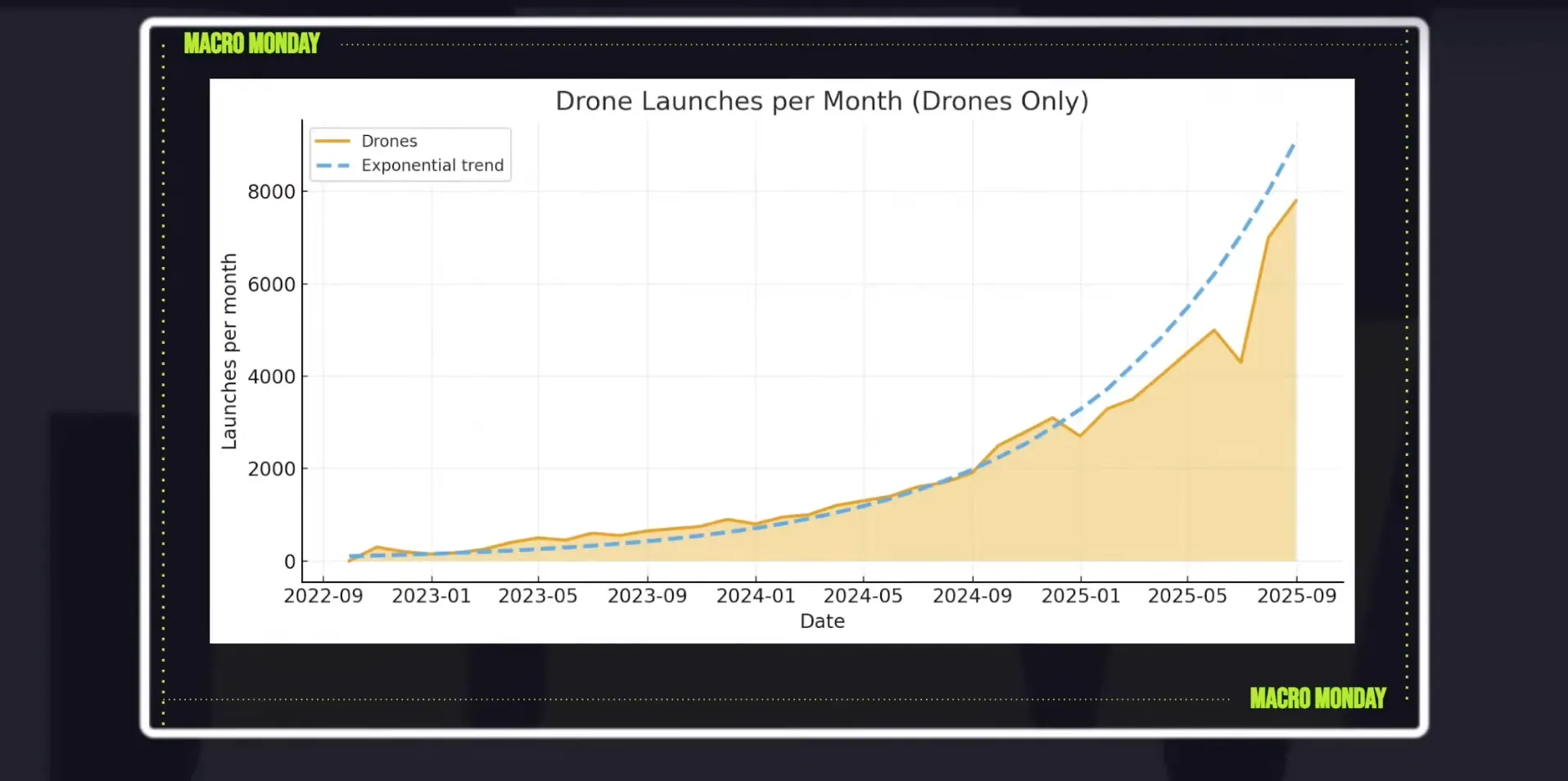

US-China Trade: Short-Term Calm, Long-Term Storm

Trade tensions influence Bitcoin through market sentiment and supply chain expectations. Recent talks about a "Thanksgiving rare earth deal" were just verbal gestures, not real agreements. History shows Trump-era trade pacts often failed to deliver, so market reactions to temporary truces have been muted.

Longer-term, the push to rebuild domestic rare earth supply chains in the US and EU is irreversible. China's use of supply chains as geopolitical tools means global disruptions will keep flowing. This risk appetite has already sent Bitcoin crashing: Trump's recent tariff comments triggered a $1.5 billion drop in 24 hours, with $190 billion in leveraged positions liquidated.

Crucially, Bitcoin's link to traditional assets has intensified. When crypto narratives fade, Bitcoin now mirrors broader risk asset moves. Trade tensions spooking global markets now directly impact Bitcoin prices.

Industry Backing: Top Players Keep Markets Stable

Despite volatility, established players provide crucial foundation. Bitwise, managing over $10 billion in assets across 30+ products, has consistently reinvested profits into developer communities since 2017-strengthening the ecosystem.

Global exchange Binance's 2.75 billion users, 24/7 support, and low fees maintain core liquidity. While unavailable in the US, Hong Kong's recent policy shift allowing global capital pools for licensed platforms offers new liquidity channels, easing regional regulatory pain points.

What's Next? Data and Signals Will Decide

Bitcoin sits at a critical crossroads. The next move depends on three key triggers: the December CPI and jobs report, Fed policy cues on the rate-cut cycle, and whether US-China trade progress becomes real. A soft inflation report pushing rate cuts *and* balance sheet expansion could lift Bitcoin above $100k. If the cut fails to materialize, $95k support could break-current models suggest a 70% chance of that happening this year.

For investors: watch for whale liquidations (815,000 BTC sold in 30 days, a 2024 high) and monitor when global liquidity cycles kick in. Bitcoin's volatility hasn't changed-but policy shifts and liquidity flows will keep steering the ship.