Bitcoin Drops Below 90,000, Ethereum Falls Below 3,000 Amid Sharp Market Correction (Nov 21)

Stone

Stone

News Briefing

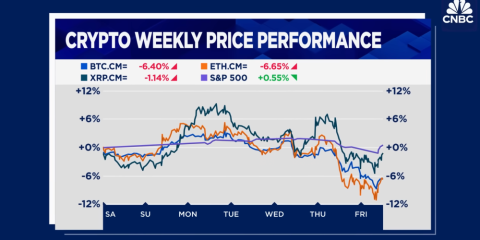

Key Price Moves: During Wednesday's U.S. morning session, Bitcoin (BTC) fell 4.2% below $90,000, while Ethereum (ETH) dropped 6.5% under $3,000—extending the selloff that began after BTC's October 10 all-time high of $126,000.

Crypto-Linked Stocks Tumble: Related equities followed the crypto slide, with Bitcoin asset manager MSTR, stablecoin issuer Circle (CRCL), Ethereum fund BMNR, and miners BITF and HIVE all down 8-9%. MSTR hit a 1-year low.

Deep Correction: According to K33 Research's Vetle Lunde, BTC has plummeted nearly 30% over 43 days—marking one of the steepest corrections since March 2017 (only seven such 50+ day corrections have occurred in crypto history).

Market Sentiment & ETF Outflows: The Crypto Fear & Greed Index remains stuck in "Extreme Fear" territory, signaling heightened risk aversion. U.S. spot Bitcoin ETFs have seen $2.3 billion in net outflows over five consecutive trading days (Farside Investors data), intensifying downward pressure.

Analyst Outlook: Lunde notes BTC has now traded below ETF average cost basis. If the decline mirrors the deepest 2023-2024 selloff, a floor could form between $84,000-$86,000; otherwise, the market might test April's low or MSTR's average entry price of $74,433.

Equities Diverge: Nasdaq rose 0.2% by midday, contrasting sharply with the crypto sell-off.

BTC Analyzer Perspective

The current crypto selloff isn't just a technical correction—it's a perfect storm of capital flight and panic selling, exposing the sector's inherent fragility as a high-volatility asset. The 30% drop over 43 days isn't merely a retracement from recent gains; it's a reckoning for the speculative rally that lacked fundamental backing. Crypto's brief period of outperforming the broader market—driven purely by ETF inflows, not real-world adoption or technological breakthroughs—collapsed once the $2.3 billion ETF outflows began.

Market sentiment and capital flight are fueling a vicious cycle: "Extreme Fear" pushes retail and some institutions to sell, while ETF outflows drain liquidity, pushing BTC below the critical ETF cost basis level. This triggers a "breakdown → sell-off → further breakdown" feedback loop. Notably, the divergence from equities (Nasdaq up 0.2% midday) breaks the historical crypto-risk asset correlation, signaling crypto is now driven by its own liquidity dynamics—not macro sentiment. This independence amplifies volatility, as there's no traditional asset to hedge against.

With two potential bottom scenarios emerging, the market is in an uncertainty phase: A rebound above $84,000-$86,000 could signal waning outflows, but a break below that might push prices toward the $74,433 support (MSTR's average entry), triggering more leveraged liquidations and sharper swings. For investors, the temptation to "buy the dip" is dangerous—until ETF flows stabilize and fear metrics exit "Extreme Fear," the market lacks clear reversal signals.

Long-term, this correction reinforces crypto's core weakness: its valuation lacks clear anchors. When prices are dictated more by capital flows and sentiment than real adoption or utility, volatility will always dwarf traditional markets. Investors must manage positions with greater caution to navigate this structural risk.