Bitcoin Correction Analysis: CNBC & Pantera Capital Perspectives

Jonathan

Jonathan

Bitcoin's recent price action has sparked significant market conversation. As of November 19, 2025, the digital asset trades around $93,000—showing minimal 24-hour volatility. The path here has been anything but smooth.

Recent Price Action

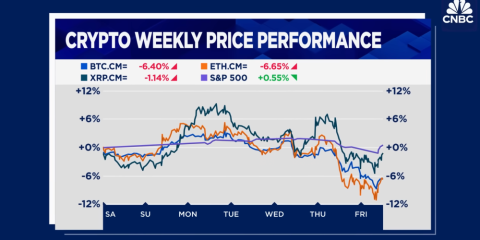

Bitcoin soared to a new all-time high of $126,296 on October 6 before entering a prolonged correction. The dip deepened last week, with prices falling below $90,000 on November 18—the first time in seven months. Within a single week, the market shed roughly 10%, erasing all of 2025's gains.

Market turbulence hit hard: October 11 saw over 180,000 liquidations totaling ~$1 billion (RMB 7.1 billion). Futures open interest dropped sharply from $70 billion to $58 billion—a historic single-day decline.

Why the Pullback?

Macro pressures: Cooling Fed rate-cut expectations tightened dollar liquidity, hitting non-yielding assets like Bitcoin. Global risk aversion pushed capital toward traditional safe havens. Then came the Trump administration's tariff policies and a 43-day US government shutdown—adding to market jitters.

Market mechanics: After six months of relentless gains, the MVRV ratio (a key valuation metric) sat near extremes. The October liquidation wave cleared out excessive leverage, triggering a chain reaction. Major holders—like a 15-year Bitcoin whale selling $1.5 billion worth—started taking profits. Meanwhile, US Bitcoin ETFs saw $558 million in net outflows on November 9, rattling investor confidence.

Is This a Crash or Normal Correction?

Bitcoin has weathered 30% corrections during past bull runs—this is typical cycle behavior. Historical drops were far steeper: 83% in 2018, 73% in 2022, 53% in 2021. The current ~26% dip sits comfortably within historical norms—far from a collapse.

Crucially, the October deleveraging cleaned house. Morgan Stanley notes Bitcoin now has "significant upside potential, surpassing gold" post-cleanup. Market leverage has returned to healthy levels, setting the stage for the next rally.

Institutionalization: The Stability Engine

Bitcoin's institutional footprint is now undeniable: 30.9% of supply held by institutions (up 924% over a decade), representing ~6.1 million BTC worth $668 billion. Key players include MicroStrategy (638,985 BTC, or 3.04% of supply), BlackRock ETFs, and Harvard University—which boosted its Bitcoin ETF stake to $443 million in Q3, making it its largest public holding.

This shift is transformative. Institutional capital brings longer horizons and stability, dampening short-term volatility. We're seeing clear signs of institutional "bottom-fishing" at current prices, creating a new price floor. The market is maturing from a retail-dominated arena to a hybrid institutional-retail ecosystem.

What's Next: Short, Medium & Long Term

Short term (1-3 months): Expect consolidation near $90,000—likely trading between $85k-$100k. Watch the December Fed meeting: higher rates could pressure prices further; a rate cut may spark a rebound. ETF inflows will be the key sentiment barometer.

Medium term (6-12 months): The 2026 April halving looms—a historical catalyst for 6-12 month price surges. Pantera Capital views this pullback as a "gradual accumulation opportunity." Potential catalysts include: a crypto-friendly US administration (taking office January 2025), and more traditional financial institutions building Bitcoin reserves.

Long term (1-3 years): Institutional ownership could reach 25%+ of circulating supply by 2030 (Scotiabank estimates), potentially pushing prices toward $500,000. Bitcoin ETF approvals and institutional custody solutions will cement its status as a mainstream asset class. As institutions deepen participation, volatility will fall, making the upward trajectory more sustainable.

Investment Approach: Key Recommendations

Based on Pantera Capital's perspective:

-

Scale in: A 30% correction is a long-term buying opportunity—avoid lump-sum entries.

-

Systematic investing: Dollar-cost averaging smooths entry costs and reduces timing risk.

-

Time horizon: Focus on 3-5+ year holds; ignore short-term noise.

-

Position sizing: Limit any single Bitcoin allocation to 10% of total capital. Keep dry powder for further dips.

-

Portfolio balance: Allocate no more than 20% to Bitcoin. Pair with traditional assets (stocks, bonds, gold) for diversification.

Conclusion

This correction is a natural cycle adjustment—not a trend reversal. The deleveraging process has significantly reduced systemic risk, while institutional adoption has boosted market stability. For long-term investors, the current dip is a compelling entry point.

Short-term volatility remains likely, but the medium-term outlook is bullish as the halving cycle approaches and institutional capital returns. The path to maturity for Bitcoin includes these corrections—making them strategic opportunities rather than reasons for panic. Key watchpoints: the December Fed meeting, ETF flows, and the 2026 halving event.