Davidson’s Bill: Bitcoin Tax Payments to Fund U.S. Strategic Reserve, Waive Capital Gains

Don

Don

Rep. Warren Davidson (R-Ohio) rolled out a fresh proposal Thursday that could let Americans pay federal taxes in bitcoin-without getting hit with capital gains taxes. The plan would funnel those bitcoin payments into a new U.S. Strategic Bitcoin Reserve.

As one of bitcoin's longest-running champions in Congress (he's been backing it since 2012), Davidson argues the bill modernizes our financial system, embraces digital asset innovation, and puts the U.S. at the forefront of the global crypto race. "While the dollar's losing ground to inflation, bitcoin's scarcity and rising adoption make it a real asset that actually gains value-especially with $38 trillion in national debt on the table," he said in a statement.

The proposal lines up with Donald Trump's March 2023 executive order that authorized the Strategic Bitcoin Reserve, though that reserve's still waiting for Congress to act. Trump's order banned using taxpayer money for the fund, but Davidson's bill lets people voluntarily contribute bitcoin via tax payments-no capital gains tax on the transaction.

Conner Brown of the Bitcoin Policy Institute called the bill a "smart, market-driven way to build up the nation's bitcoin holdings," echoing Davidson's vision.

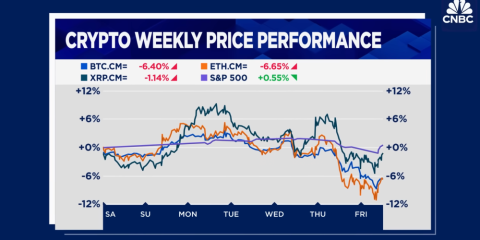

Right now, the White House is estimated to hold about 198,012 bitcoin-worth roughly $17 billion-but Arkham's federal reserve tracker's down, so we can't confirm the exact number. The timing's interesting: the bill drops amid bitcoin's recent price swings, and with Congress in its final stretch, it'll likely become a talking point for future crypto tax talks. For now, industry lobbyists are still focused on Senate efforts to shape crypto market rules.

BTC Analyzer Perspective

Davidson's proposal isn't just about getting more people to use crypto-it's a smart move to make Bitcoin a formal part of the U.S. treasury. Instead of fighting through tax rules, it uses voluntary tax payments (not public money) to build a Bitcoin reserve. Think of it as turning everyday tax filings into a quiet way to grow the government's crypto holdings. They're starting with the White House's existing stash of 198,000 BTC-worth roughly $17 billion-and letting it expand naturally. If this passes, it could shift how Washington views Bitcoin: not just as digital cash, but as a tool for managing national finances. And timing it amid Bitcoin's wild swings? That's not about quick wins. It's about laying the groundwork for how future budgets might work. For central banks around the world, this could be the first real playbook for handling digital assets.