Bitcoin Sentiment Turning Point: Resistance Breakout Analysis (Nov 14, 2025)

Daisy

Daisy

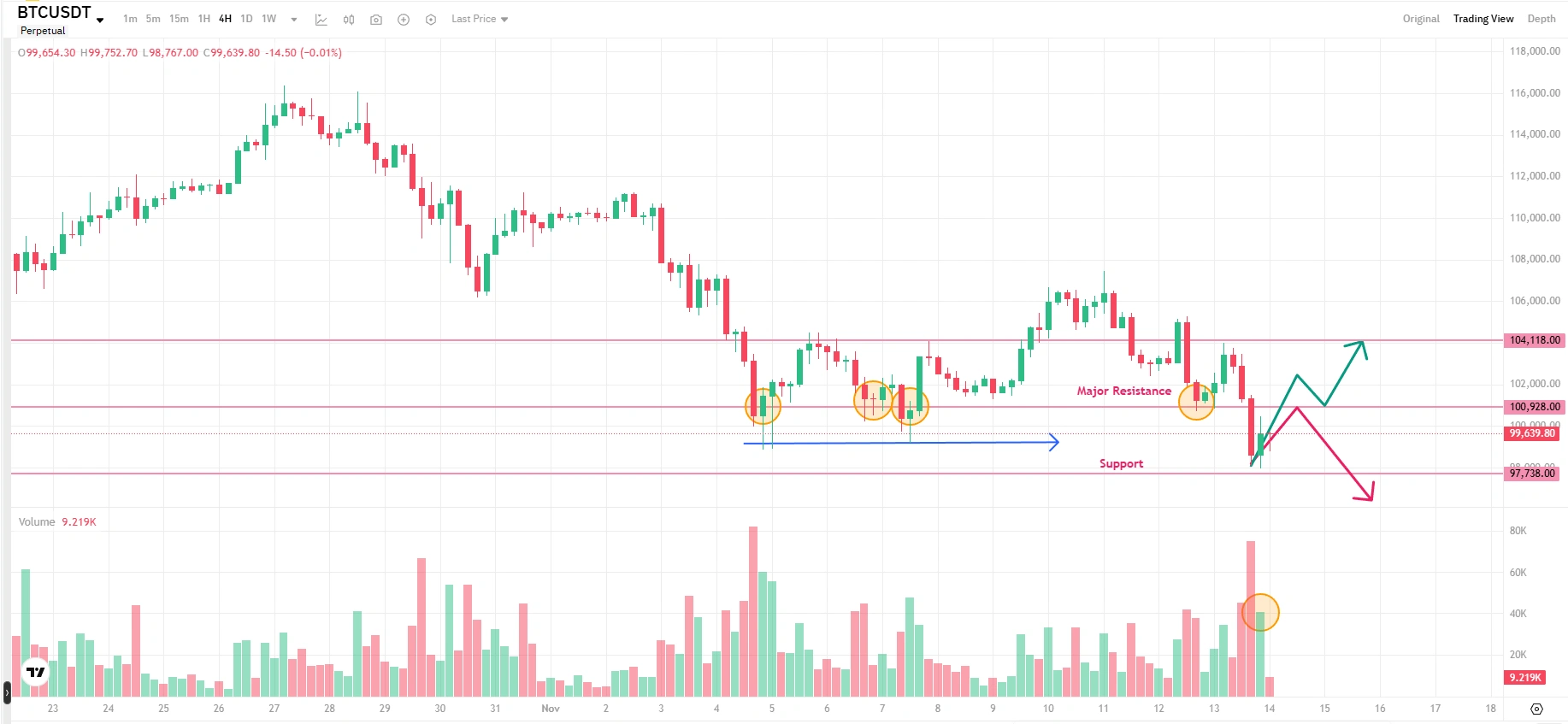

100,928 Resistance: The Short-Term Trend Battleground

In the 4-hour BTCUSDT chart, price rebounded from a critical support at $97,738 after a pullback from highs. We're now in a tight battle between bulls and bears around this zone. $97,738 remains the key defensive line for buyers, while $100,928 is the immediate resistance to watch. A clean break above $100,928 could push Bitcoin toward the next resistance at $104,118. The recent long-legged candlesticks with heavy volume near these levels tell the story: traders are fighting hard on both sides. If price breaks $100,928 with volume and holds above it, a move toward $104,118 is likely. Failure here, however, combined with a close below $97,738, could send Bitcoin lower. Ultimately, whether $100,928 holds or breaks will determine the short-term path—and volume confirmation is essential.

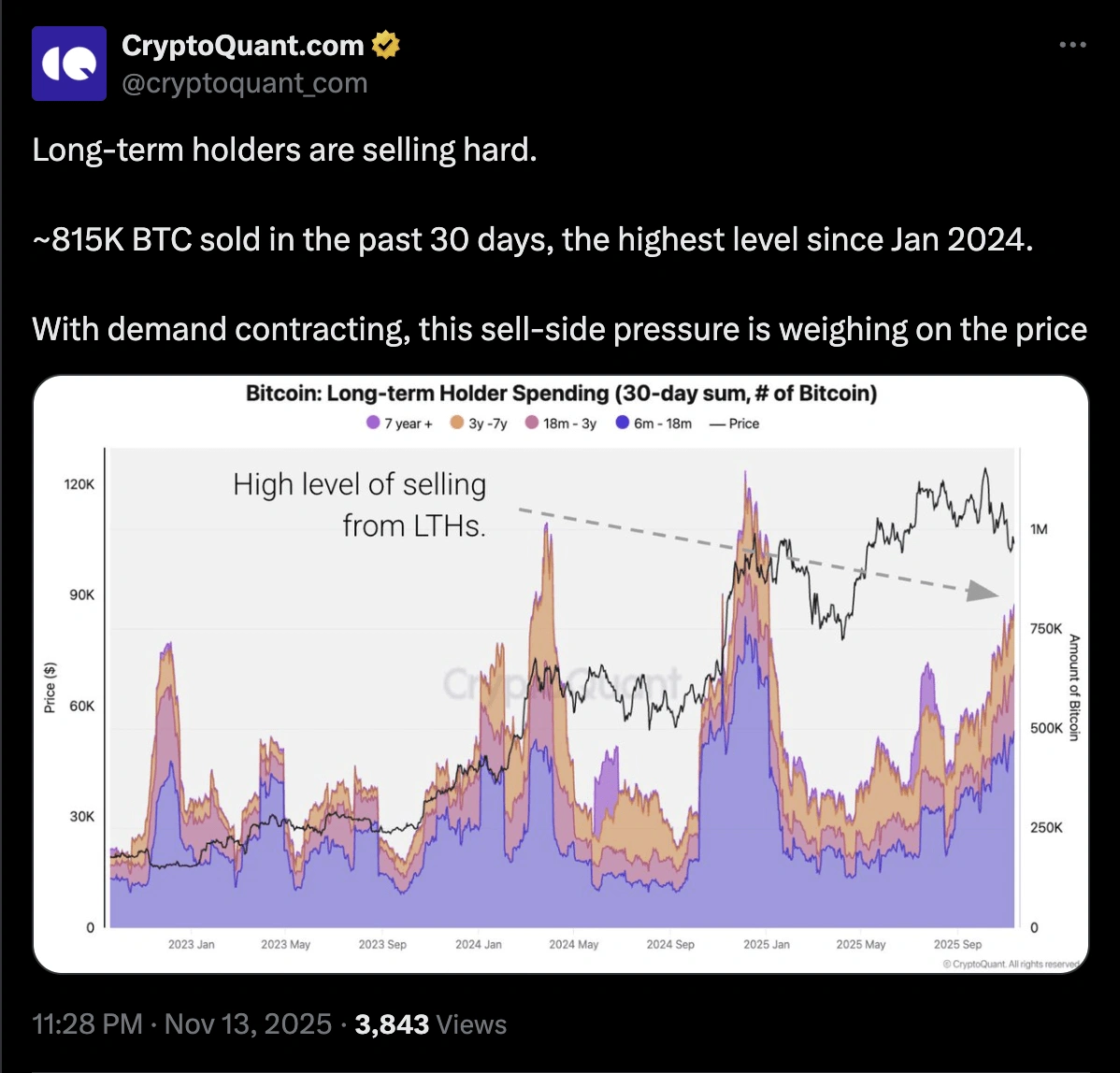

Sell Pressure vs. Reversal Signals: A Market Crossroads

Bitcoin sits at a pivotal point: short-term selling pressure clashes with long-term upside potential. The recent 815,000 BTC dumped over the past 30 days (a 2024 high) has been a major drag on price, squeezing demand near the $100,000 mark. Crucially, this isn't forced liquidation—it's profit-taking by long-term holders ("whales"), signaling cautious sentiment among key investors.

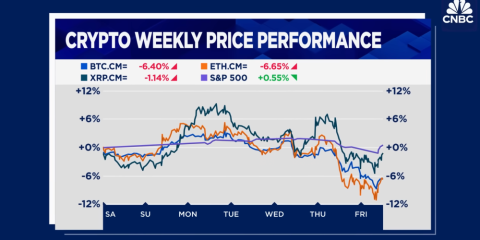

Market fear has amplified the pressure. The Crypto Fear & Greed Index now sits at 15 (extreme fear), the lowest since March and the highest fear in six months. Retail investors are fleeing, while U.S. spot Bitcoin ETFs saw four consecutive days of net outflows—$1.34 billion total. Meanwhile, the post-government shutdown rally in gold and silver has siphoned liquidity away from crypto, worsening the strain.

But signs of a potential turnaround are emerging. Santiment notes the market is nearing a turning point, with key players accumulating during the dump. Major firms like Strategy are still buying, signaling institutional confidence. More importantly, Trump's planned $2,000 stimulus checks could inject fresh liquidity—echoing his pro-crypto stance that previously drove $10 billion into ETFs. While $100,000 remains a tough barrier, and a break below could trigger further declines, the combination of liquidity expectations and institutional accumulation may limit downside.

For now, Bitcoin is stuck in a tug-of-war between short-term selling and long-term optimism. Watch $100,000 for immediate stability, and track the timing of stimulus rollout. Longer term, the path depends on sustained institutional inflows, global liquidity shifts, and regulatory moves. Stay alert to volatility, but monitor subtle shifts in sentiment and capital flow.

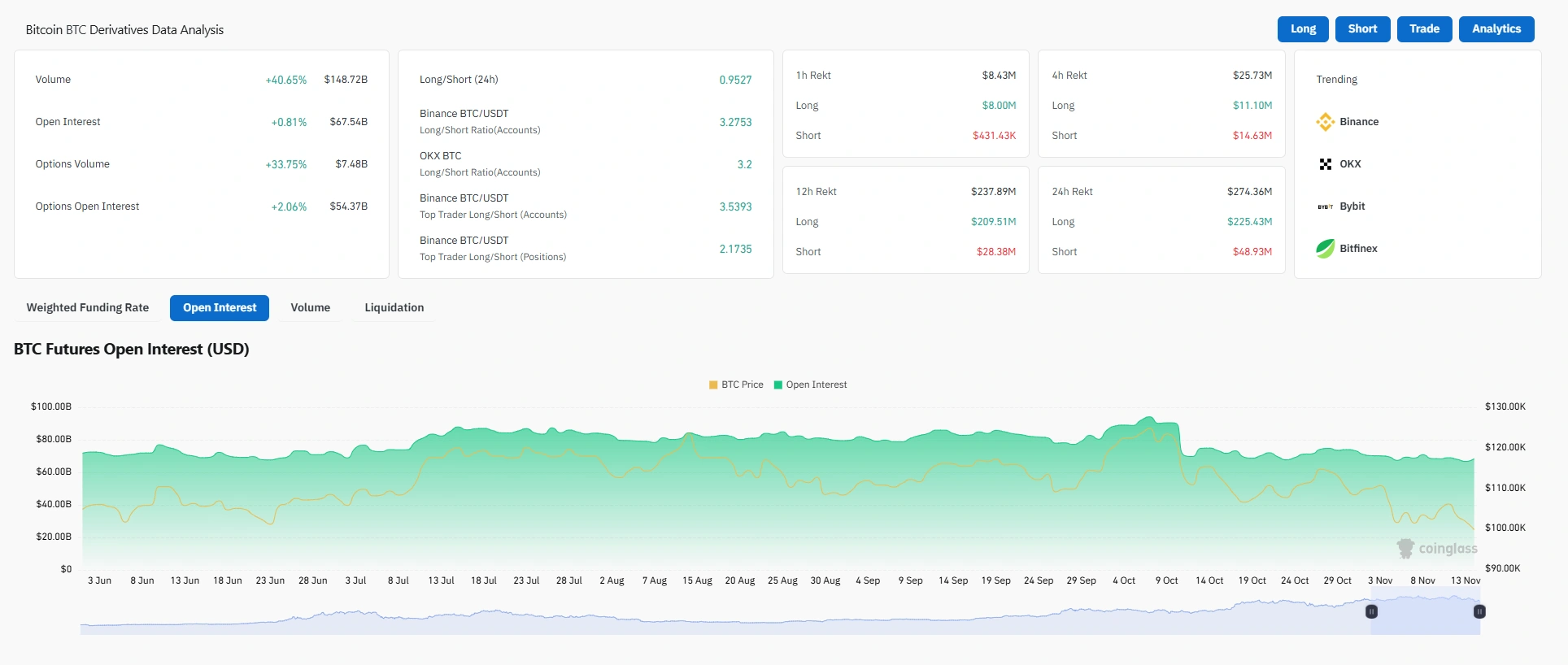

Derivatives Activity: Slight Rise in Open Interest

Bitcoin derivatives markets are heating up. Futures volume jumped 40.47% to $148.5 billion, while options volume rose 33.66% to $7.46 billion. Open interest in futures grew 0.62%, and options open interest increased 2.06%—showing deeper capital commitment. Sentiment is split: the 24-hour aggregate long/short ratio sits at 0.95 (slightly bearish), but Binance, OKX, and Binance's institutional accounts all show ratios well above 1. Retail and big players are leaning bullish, intensifying the battle. Expect choppy price action as the market tests which side gains momentum.